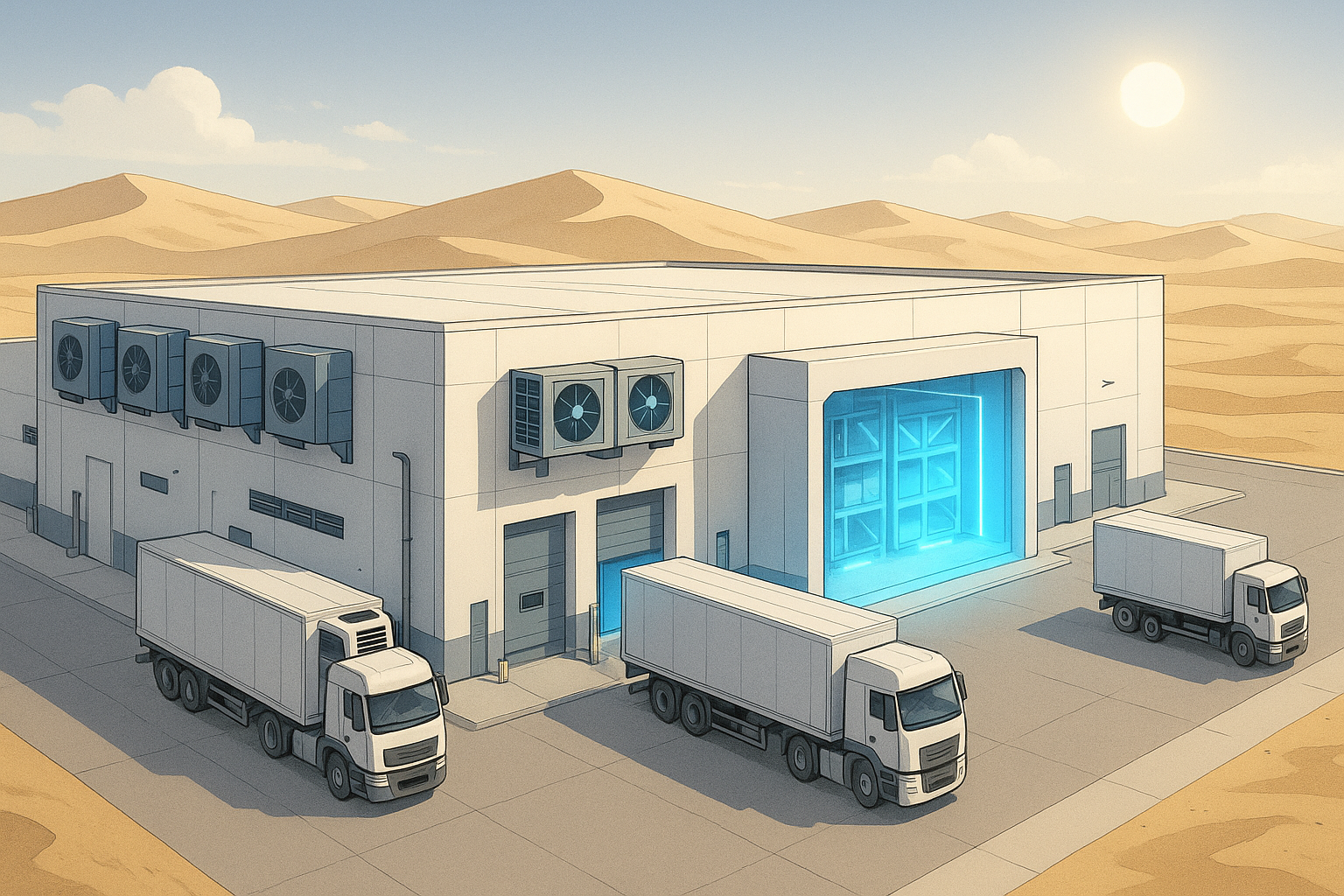

Cold Chain Infrastructure: The Next Competitive Edge in Gulf Logistics

Explore how advanced cold chain infrastructure is essential for maintaining product quality in the Gulf's extreme climate, driving growth in logistics.

The Gulf's extreme climate and its role as a global trade hub make advanced cold chain systems indispensable. These systems ensure temperature-sensitive goods like food and pharmaceuticals are stored and transported safely, addressing rising demand and strict regulations.

Key takeaways:

- Why it matters: The Gulf’s high temperatures and humidity challenge the integrity of sensitive goods, requiring sophisticated cold chain logistics.

- Core elements: Advanced refrigeration, real-time monitoring, and tailored storage solutions maintain product quality.

- Driving sectors: Pharmaceuticals, food security, and medical tourism are pushing demand for reliable cold chain systems.

- Growth opportunities: Investments in automation, energy-efficient cooling, and regional hubs like Dubai and Saudi Arabia are shaping the future.

The Gulf’s focus on cutting-edge technologies, regulatory compliance, and resilient infrastructure positions it to lead in the global cold chain market.

Gulf Food 2025: How Dubai’s Secret Logistics Empire Stops Food Fraud (AI + Blockchain)

Market Context for Gulf Cold Chain

The Gulf's cold chain industry thrives on the region's heavy reliance on imports, evolving trade dynamics, and stringent regulations. These elements have made advanced cold chain infrastructure a key factor for staying competitive in the market.

Demand Drivers and Key Trade Routes

The Gulf region depends significantly on imports to meet its needs for perishable goods like food and pharmaceuticals. This reliance, combined with growing demand, has created a pressing need for consistent temperature control from the product's origin to its final destination.

The Gulf’s strategic location further emphasises the importance of reliable systems to maintain the quality of temperature-sensitive goods. Additionally, the rise of e-commerce has reshaped consumer expectations, pushing cold chain operators to create customised last-mile solutions. Many are now setting up smaller, decentralised facilities closer to urban areas to meet these demands efficiently.

Key trade routes connecting the Gulf to Europe, East Africa, and Asia introduce specific challenges in maintaining optimal temperatures, making robust infrastructure essential.

Beyond the logistical demands, compliance with strict regulatory frameworks also shapes how cold chain services operate in the region.

Regulatory Standards and Compliance Requirements

Cold chain operations in the Gulf must adhere to a mix of international standards and local regulations aimed at ensuring product safety and streamlining cross-border trade. These rules often require continuous temperature monitoring, validated storage systems, and precise documentation of any temperature fluctuations.

For both food and pharmaceutical supply chains, regulations stress the importance of monitoring critical control points throughout the process. Regional authorities have also introduced faster procedures and stricter certification protocols to enhance the safety of temperature-sensitive goods. Recent updates to these regulations have focused on improving monitoring technologies and enforcing tighter compliance measures.

This combination of operational and regulatory demands underscores the importance of advanced cold chain systems in maintaining the quality and safety of perishable products throughout the Gulf region.

Core Components of Cold Chain Infrastructure

Cold chain infrastructure is built on a network of systems designed to keep products at precise temperatures throughout their journey. These systems are especially vital in the Gulf, where extreme heat and strict regulations pose unique challenges. Below, we explore essential temperature ranges and the specialised designs that shape cold chain facilities.

Temperature Ranges and Applications

The success of cold chain operations hinges on maintaining specific temperature ranges tailored to different products. Here's a closer look at the main categories:

- Ultra-low temperature storage (-80°C to -60°C): Primarily used by pharmaceutical companies, this range is essential for storing vaccines, biological samples, and specialised medications.

- Frozen storage (-25°C to -18°C): A key segment in the Gulf due to the reliance on imported frozen foods, this range supports items like ice cream, frozen meals, and some pharmaceuticals. The growing food service industry further fuels demand here.

- Chilled storage (0°C to 8°C): Ideal for fresh produce, dairy, and temperature-sensitive pharmaceuticals. This range has gained traction as consumers increasingly prefer fresh foods and as pharmaceutical imports rise.

- Controlled ambient storage (15°C to 25°C): With added humidity control, this range caters to products like chocolate, certain medications, and wine. Though smaller in scale, it’s expanding as luxury imports grow in the region.

Choosing the right temperature range impacts facility design, energy consumption, and operational costs. Facilities managing multiple ranges require advanced systems to separate zones and avoid temperature breaches.

Facility Types and Technologies

Cold chain infrastructure relies on various facility types, each tailored to specific needs. Here's a breakdown:

- Cross-dock facilities: Designed for rapid transfers without long-term storage, these facilities maintain temperature control during loading and unloading. Positioned near airports and seaports, they are critical for Gulf logistics.

- Multi-chamber warehouses: These facilities house multiple temperature zones under one roof. Advanced insulation and airflow systems help maintain distinct environments, while adjustable zones accommodate seasonal demand changes.

- Automated storage and retrieval systems: Found in larger warehouses, these systems use robotics to handle inventory in controlled environments. They minimise human exposure to extreme temperatures, improve accuracy, and reduce energy use by limiting lighting and air circulation.

- Urban micro-fulfilment centres: Compact and located near city centres, these facilities (500 to 2,000 square metres) support last-mile deliveries. They often feature compact refrigeration and automated picking systems to streamline operations.

Operators in the Gulf often invest in hybrid facilities that combine elements of these designs, offering flexibility to meet varying demands and integrate seamlessly into existing supply chains.

Refrigeration and Power Systems

Reliable refrigeration and power systems are the backbone of cold chain operations in the Gulf. Here’s how facilities are addressing these critical needs:

- Ammonia-CO₂ cascade systems: These systems combine ammonia and carbon dioxide for efficient cooling, performing well in high ambient temperatures while offering strong energy efficiency and lower environmental impact.

- Direct expansion systems: Common in smaller facilities, these systems use synthetic refrigerants. They are simpler to maintain and cost less upfront, though they are less energy-efficient than cascade systems.

- Power backup and solar integration: Given the variability of electrical grids in the Gulf, facilities rely on diesel generators capable of sustaining refrigeration systems for 24 to 72 hours. Solar panels are increasingly used to offset cooling demands during the day, though careful integration is crucial for reliability.

- Thermal energy storage: By freezing water or other materials during off-peak hours, these systems store cooling capacity for use during peak demand, helping reduce energy costs and easing strain on the grid.

Investments in redundant systems, predictive maintenance, and advanced technologies are growing as operators aim to minimise risks, avoid costly temperature excursions, and ensure regulatory compliance. The reliability of these systems is directly tied to product quality and operational success.

Technologies Transforming Cold Chain Operations

With the solid infrastructure already in place, cutting-edge technologies are now reshaping cold chain operations across the Gulf. These advancements are addressing regional challenges while opening up new avenues for efficiency and growth.

Warehouse Automation and Digital Twins

Modern cold chain facilities in the Gulf are increasingly relying on automated storage and retrieval systems. These systems not only reduce human exposure to harsh cold environments but also ensure precise inventory management. Robotic systems designed for cold temperatures are becoming more reliable, thanks to improved components and specialised lubricants, making them essential for maintaining accuracy and preventing contamination - especially in pharmaceutical storage.

Another game-changer is digital twin technology, which creates virtual models of physical operations. These replicas monitor operations in real time, identifying issues early and enabling proactive maintenance. Paired with artificial intelligence, these systems optimise space usage based on product turnover and temperature needs. For example, during Ramadan, when demand patterns shift, these technologies allow facilities to adjust dynamically, improving energy efficiency and overall performance. Together, automation and digital twin technologies are elevating cold chain operations to new levels of precision and adaptability.

Energy Efficiency and Thermal Solutions

The Gulf's challenging climate has driven the development of advanced energy-efficient cooling technologies. Modern thermal insulation materials are designed to withstand the region's high temperatures, ensuring that cold storage environments remain stable.

Refrigeration systems are evolving too, with carbon dioxide-based cooling systems offering both environmental benefits and operational stability. These systems perform well even when power conditions fluctuate. Additionally, facilities are integrating thermal energy storage systems with renewable energy sources. These systems store cooling capacity during off-peak hours and release it when needed, reducing energy costs and supporting sustainable operations.

Smart building management systems are playing a crucial role in energy optimisation. By coordinating HVAC, lighting, and refrigeration, these systems shift cooling loads to off-peak hours, cutting energy usage. Heat recovery systems are also gaining traction, capturing waste heat from refrigeration processes and repurposing it for other facility needs, further enhancing energy efficiency.

Packaging Solutions for Temperature Control

The Gulf's extensive trade routes demand packaging solutions that can maintain stable temperatures over long distances. Phase-change material (PCM) packaging has become a reliable option, as it absorbs and releases thermal energy to keep shipments within the required temperature range.

Reusable insulated containers are also advancing, now featuring sensors and GPS tracking to monitor conditions throughout the supply chain. Similarly, smart packaging with temperature indicators and data loggers provides detailed thermal tracking, which is critical for pharmaceutical products that must meet strict regulatory standards.

Vacuum-insulated packaging offers compact, efficient thermal performance, while biodegradable insulation materials made from agricultural by-products are emerging as eco-friendly alternatives. By combining these innovations, cold chain operations are becoming more efficient, reliable, and responsive to market demands. Facilities adopting these technologies are seeing reduced costs, better product quality, and improved compliance with regulations.

Market Trends and Investment Opportunities

With the advancements in technology and infrastructure shaping the landscape, Gulf cold chain logistics is poised for notable growth. As trade volumes increase and consumer needs shift, investment in this sector is gaining momentum, setting the stage for transformative developments.

Regional Capacity and Key Hubs

Dubai's Jebel Ali continues to lead as the region's primary cold chain hub, with ongoing expansions in storage capacity solidifying its role as a key re-export centre for temperature-sensitive goods. Saudi Arabia's King Abdullah Port has enhanced its cold storage facilities along the Red Sea, offering better access to European and African markets. Qatar's Hamad Port has upgraded its facilities to include pharmaceutical-grade storage, positioning itself as a hub for medical distribution in the region. Meanwhile, Oman and Kuwait are steadily expanding their storage capacities to support niche exports and meet growing local demand.

Cost Structure and Economics

Investment decisions in the Gulf's cold chain sector are heavily influenced by factors like land lease rates and energy costs, which vary significantly across the region. Industrial electricity rates, in particular, play a major role in shaping the economics of energy-intensive operations. Construction costs also differ depending on temperature requirements and the level of automation, with pharmaceutical-grade facilities typically incurring higher expenses due to strict regulatory standards and the need for backup systems. Larger facilities benefit from economies of scale, while automation helps cut labour costs and minimise product losses. These economic factors are central to the strategies cold chain operators adopt to remain resilient.

Risk Management and Resilience Planning

Operators across the Gulf are focusing on building robust resilience strategies. These include redundant power systems, diversified routing through multiple ports, and the use of digital documentation to ensure smooth operations. Facilities are also designed to handle extreme conditions, with advanced insulation and climate-controlled docks ensuring temperature stability. Diversifying supply chains through partnerships with multiple countries helps reduce reliance on single sources - a critical factor for pharmaceutical logistics. Predictive maintenance technologies, such as IoT sensors and analytics, are being deployed to minimise equipment downtime and maintain stable temperature conditions for sensitive products.

Conclusion: Building Cold Chain Infrastructure for Gulf Logistics

The Gulf region finds itself at a critical juncture where cold chain infrastructure can define its position in global trade. With the rise in temperature-sensitive goods and stricter regulations, companies that prioritise smart investments in these systems are poised to gain a competitive edge.

Key Considerations for Gulf Logistics Leaders

To capitalise on the region's shifting trade landscape, leaders must prioritise investments that deliver tangible results. Cold chain systems not only broaden product capabilities - allowing for the safe handling of high-value pharmaceuticals and premium food items - but also ensure compliance with international standards, which is essential for seamless global trade.

Operational reliability is another cornerstone. Facilities equipped with backup systems, advanced monitoring tools, and predictive maintenance can maintain uninterrupted service during disruptions. This reliability not only safeguards customer trust but also supports premium pricing models when competitors falter due to equipment failures or temperature issues.

Efficiency is equally important. While pharmaceutical-grade facilities may demand higher upfront costs, their ability to offer specialised services and secure long-term contracts with global corporations ensures strong financial returns.

Strategic location also plays a vital role. Emerging hubs like King Abdullah Port and established centres such as Jebel Ali offer first-mover advantages. Tailoring facilities to market needs - whether for pharmaceuticals, food products, or industrial chemicals - will be critical to capturing demand as trade patterns evolve.

Future Outlook and Growth Opportunities

The road ahead for the Gulf's cold chain sector is marked by innovation and collaboration. Automation and energy-efficient technologies will be key drivers, with tools like IoT sensors, blockchain, and artificial intelligence enabling real-time supply chain visibility. Such digital integration will soon become the industry standard.

Cross-border cooperation offers another avenue for growth. As trade agreements expand and regulations align across Gulf nations, integrated cold chain networks connecting cities like Dubai, Riyadh, and Doha will be well-positioned to attract multinational corporations looking for seamless regional distribution solutions.

Sustainability is also reshaping the industry. Solar-powered refrigeration, advanced insulation, and waste heat recovery systems are becoming essential as businesses aim to meet environmental goals. Companies that adopt these technologies early can benefit from incentives and gain favour with eco-conscious customers.

The pharmaceutical industry, in particular, holds immense potential. With the Gulf emerging as a manufacturing and distribution hub for Africa and Asia, there is an opportunity to dominate premium market segments with limited competition.

Balancing immediate gains with forward-thinking investments will set the stage for regional leadership. By building robust cold chain systems, the Gulf can secure its place as a key player in the interconnected global economy.

FAQs

How does the Gulf's climate affect the storage and transport of temperature-sensitive goods, and what solutions are being implemented to overcome these challenges?

The Gulf’s intense heat and high humidity create serious challenges for handling temperature-sensitive goods like food and pharmaceuticals. These harsh conditions not only raise the risk of spoilage but also push refrigeration costs higher, making reliable cold chain logistics absolutely critical.

To tackle these issues, the region is turning to cutting-edge solutions like solar-powered cooling systems, smart warehouses, and energy-saving refrigeration technologies. At the same time, there’s a growing focus on eco-friendly logistics practices that help minimise environmental impact while safeguarding the quality of these delicate products. These forward-thinking approaches are helping cold chains remain effective, even in the Gulf’s tough climate.

What technological innovations are driving the growth of cold chain infrastructure in the Gulf, and how are they enhancing efficiency?

Technological innovations like IoT-enabled temperature monitoring, blockchain for tracking product origins, AI-driven logistics, and automation are reshaping cold chain infrastructure in the Gulf. These tools enable real-time tracking, minimise spoilage, and streamline supply chain processes - essential for handling temperature-sensitive items such as pharmaceuticals and fresh produce.

Upgraded refrigeration systems and advanced data analytics also play a key role by enhancing responsiveness and efficiency. They help maintain precise temperature control and improve operational reliability. Together, these advancements are meeting the rising demand for reliable cold chain solutions in the region, driving growth in industries and strengthening the logistics sector's competitive edge.

How do Gulf regulations impact the development and operation of cold chain systems for pharmaceuticals and food?

Regulations across the Gulf region significantly influence how cold chain systems operate, especially when it comes to pharmaceuticals and food. The GCC guidelines, among other standards, enforce strict protocols for handling, storage, and transportation to safeguard product quality and safety. To meet these requirements, businesses are investing in advanced technologies like temperature monitoring and tracking systems.

Although specific rules differ between Gulf countries, the collective focus remains on improving standards and encouraging innovation in cold chain infrastructure. This not only ensures the safe delivery of temperature-sensitive products but also strengthens consumer trust and meets the rising demand for dependable logistics solutions in the region.