Red Sea Disruptions and the Case for Inland Supply Chain Hubs

Explore the shift from Red Sea-dependent supply chains to inland hubs, highlighting risk reduction, cost efficiency, and operational flexibility in logistics.

Global supply chains face increasing risks, and the Red Sea corridor - a key maritime route - is no exception. For the UAE and GCC, disruptions in this area, caused by geopolitical tensions or natural events, can severely impact industries dependent on imports. This includes sectors like power infrastructure, manufacturing, and agriculture.

To tackle these challenges, inland supply chain hubs are emerging as a strong alternative to port-reliant systems. These hubs decentralise logistics, reduce dependency on vulnerable maritime routes, and support local manufacturing. They also align with the UAE's diversification goals by improving supply chain stability and boosting economic growth.

Key Takeaways:

- Red Sea Risks: Delays, cyberattacks, and rising costs make maritime routes less reliable.

- Inland Hubs Advantages: Lower costs, fewer risks, and scalability for businesses.

- Hybrid Approach: Combining ports and inland hubs ensures global connectivity while improving resilience.

For businesses in the UAE and GCC, inland hubs offer a practical solution to mitigate risks, manage costs, and support growth in an uncertain trade environment.

1. Red Sea-Dependent Supply Chains

Supply chains relying on Red Sea routes come with their own set of challenges. By examining these, it’s easier to understand why businesses in the UAE and across the GCC are rethinking their logistics strategies.

Risk Exposure

Relying heavily on a single maritime route, like the Red Sea, brings significant risks. The Bab el-Mandeb strait, a narrow but vital passage for global trade, is a prime example. When regional tensions flare up, shipping companies often divert to longer routes, adding considerable delays to transit times.

These delays can have a domino effect. For industries in the UAE, such as automotive assembly and electronics manufacturing, which depend on just-in-time delivery systems, even minor disruptions can throw operations off track. There’s little room for error when timing is everything.

Then there’s the growing threat of cyberattacks. Ports and other shipping infrastructure along the Red Sea have become frequent targets. A single cyber incident at a key port can ripple across the entire logistics network, causing widespread disruptions. This highlights the urgency for businesses to explore alternative routes and strategies.

Cost Efficiency

Historically, Red Sea routes have been cost-effective, offering shorter transit times and well-developed infrastructure. But recent disruptions have unveiled hidden expenses. For instance, during unstable periods, freight rates often spike as shipping lines factor in additional risk-related charges.

Taking alternative routes not only increases travel distances but also drives up fuel consumption, adding to overall logistics costs. For UAE-based businesses, particularly retailers and importers, these rising expenses can squeeze profit margins.

Insurance costs add another layer of complexity. Maritime insurance premiums tend to fluctuate during high-risk periods, making it harder for businesses to plan financially. This unpredictability in costs only adds to the pressure on traditional supply chain models.

Operational Flexibility

Adapting to disruptions is no easy feat for supply chains tied to the Red Sea. The region’s established infrastructure and long-standing relationships often make shifting to alternative solutions a slow and challenging process.

Unreliable transit times force UAE distributors to stockpile goods as a precaution, which ties up working capital and raises warehousing costs - especially for items requiring specialised storage. This lack of flexibility can strain resources further.

Contractual terms are another sticking point. Many businesses in the UAE find that traditional contracts fail to account for the frequency and duration of modern shipping disruptions. This can lead to disputes over missed delivery deadlines and penalty clauses. The rigidity of these supply chains underscores the growing importance of inland logistics hubs within the UAE and GCC to provide a buffer against such challenges.

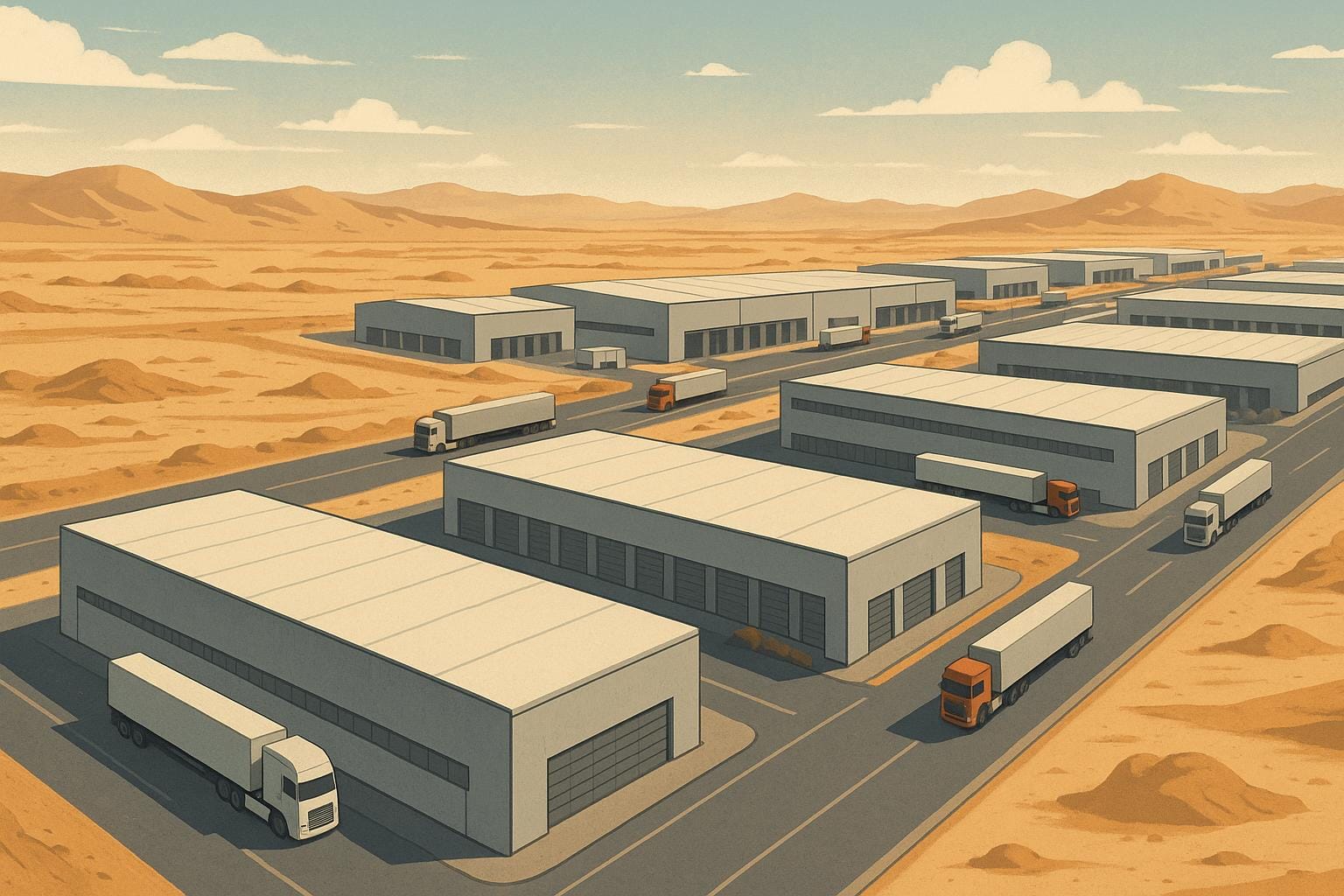

2. Inland Supply Chain Hubs

Inland supply chain hubs are proving to be a strong alternative to the traditionally port-reliant logistics systems. Located away from coastal areas, these hubs offer businesses greater control over their operations while addressing key challenges like risk exposure, cost management, and operational adaptability. Let’s dive into how these inland hubs are transforming supply chains in the GCC region.

Risk Exposure

Inland hubs significantly reduce the risks tied to maritime logistics. Ports, while critical, are vulnerable to congestion, labour strikes, and even geopolitical conflicts. Inland distribution centres, on the other hand, operate with fewer external pressures, offering a more stable environment for supply chain operations.

One of their biggest strengths is geographic diversification. By spreading operations across multiple inland locations, businesses can maintain continuity even if certain routes or regions face disruptions. This strategy ensures that risks are distributed across different areas and transport methods.

Additionally, inland hubs lessen reliance on key chokepoints like the Suez Canal or Bab el-Mandeb. Goods can be rerouted through alternative paths, ensuring supply chain stability even during maritime tensions. This flexibility is crucial for businesses aiming to navigate uncertain conditions without compromising operations.

Cost Efficiency

Inland hubs aren’t just about risk management - they also deliver notable cost benefits. For businesses in the GCC, inland hubs often come with lower land and labour costs, which translates to larger, more affordable facilities and reduced operational expenses.

Though last-mile delivery distances might increase for some markets, inland hubs make up for it with better connectivity to road and rail networks. This improved access can lower overall transport costs, especially for companies serving multiple regional markets at once.

The combination of affordable land, reduced labour expenses, and optimised transport networks allows businesses to streamline inventory management while keeping costs under control.

Scalability

As the UAE and GCC economies continue to diversify, scalable logistics solutions are becoming essential. Inland hubs offer the space and affordability needed to support long-term growth. Businesses can expand their operations without the need for complete relocation, thanks to the availability of land for expansion.

These hubs also allow for tailored infrastructure. Facilities can be designed to meet specific operational requirements, ensuring they grow in line with business needs.

Another key benefit is the ability to integrate multiple transport modes. Inland hubs can connect road, rail, and air freight services, giving businesses the flexibility to scale different parts of their logistics network as demand shifts. Additionally, purpose-built inland hubs make it easier to incorporate modern technologies like automation, advanced inventory systems, and data analytics, all of which are critical for sustainable growth.

Operational Flexibility

Inland hubs bring a level of operational flexibility that port-dependent facilities often can’t match. With access to road, rail, and air freight, businesses can choose the most cost-effective and time-sensitive transport options based on their needs.

Customs procedures are often more streamlined at inland hubs, helping businesses maintain operational continuity with faster processing times. These facilities also offer adaptable storage and handling solutions, capable of accommodating everything from temperature-sensitive pharmaceuticals to bulk goods - unlike the space-constrained environments of ports.

Extended operating hours further enhance flexibility. Inland hubs can more easily run 24/7 operations, free from the maritime schedules and international coordination that ports require.

Finally, proximity to manufacturing centres makes inland hubs a strategic choice for supplier integration. Being closer to production sites allows for quicker adjustments to supply chain demands and simplifies coordination with multiple logistics providers, especially across long maritime routes.

Advantages and Disadvantages

When weighing the options between Red Sea-dependent supply chains and inland hubs, businesses must carefully consider factors like risk, cost, scalability, and flexibility. Below is a table that highlights the key trade-offs for each model.

| Factor | Red Sea-Dependent Supply Chains | Inland Supply Chain Hubs |

|---|---|---|

| Risk Exposure | Advantages: Immediate access to global markets through established shipping routes Disadvantages: High vulnerability to regional instability and maritime disruptions |

Advantages: Geographic diversification and a stable operating environment Disadvantages: Limited direct access to international shipping routes |

| Cost Efficiency | Advantages: Benefits from established port networks and economies of scale Disadvantages: Higher insurance costs during disruptions and limited space for expansion |

Advantages: Lower costs for land, labour, and facilities; better regional distribution options Disadvantages: Higher last-mile delivery costs for coastal areas and increased expenses for international connectivity |

| Scalability | Advantages: Access to global shipping networks, strong trade relationships, and proximity to international markets Disadvantages: Limited room for expansion, high property costs, and dependence on port capacity |

Advantages: Ample space for growth, flexible designs, and integration with multiple transport modes Disadvantages: Requires investment in infrastructure and longer lead times for international connectivity |

| Operational Flexibility | Advantages: Direct maritime connections, established customs processes, and fixed shipping schedules Disadvantages: Reliance on maritime schedules, limited operating hours, and international coordination challenges |

Advantages: Round-the-clock operations, adaptable storage solutions, and proximity to manufacturers Disadvantages: Coordination across multiple transport modes and potential delays in processing international shipments |

This comparison shows that Red Sea-dependent supply chains shine in terms of international connectivity, making them ideal for businesses heavily involved in global trade. However, they come with significant risks and operational limitations, particularly for companies that need to mitigate disruptions or expand operations.

On the other hand, inland hubs provide better risk management and operational control, with the added benefit of scalability. These hubs are well-suited for businesses focused on regional markets or those needing flexible operations to respond to changing demands. The trade-off is the need for additional investment in infrastructure to improve international connectivity.

Ultimately, the decision between these two approaches depends on a company's market focus, risk appetite, and growth strategy. For businesses prioritising regional markets, inland hubs often offer a more cost-efficient and adaptable solution. Meanwhile, companies that rely heavily on international trade may favour Red Sea access despite its vulnerabilities.

In the GCC, many companies adopt a hybrid model, combining the strengths of both approaches. This strategy ensures they maintain global connectivity while enhancing resilience through geographic diversification and operational adaptability.

Conclusion

The comparison of inland hubs and maritime logistics highlights a compelling case for businesses in the UAE and across the GCC to consider inland supply chain hubs as a viable alternative. With disruptions in the Red Sea exposing vulnerabilities in maritime logistics, inland hubs present a chance to rethink traditional supply chain strategies.

While Red Sea-dependent supply chains provide essential global connectivity, they also come with risks - route congestion, regional instability, and rising operational costs. Inland hubs, on the other hand, offer a way to diversify geographically, operate with greater flexibility, and expand efficiently. They sidestep the constraints of maritime schedules while benefiting from cost advantages in land and labour.

As the GCC pursues diversified logistics strategies, a hybrid model that blends maritime and inland solutions stands out. This approach ensures businesses maintain global trade access while simultaneously building resilience against disruptions - a critical factor in today’s uncertain trade landscape.

For the UAE, developing inland hubs is not just about risk mitigation; it’s about securing a competitive edge for the future. This shift aligns with the region's broader ambitions to reduce reliance on unpredictable maritime routes. In a rapidly changing trade environment, inland hubs offer the reliability, adaptability, and operational efficiency needed to meet evolving market demands across the GCC and the wider MENA region.

FAQs

What makes inland supply chain hubs a better alternative to port-dependent systems in the GCC region?

Inland supply chain hubs bring a host of benefits compared to traditional port-focused systems, especially in the GCC region. By shifting some of the logistics burden away from congested seaports, these hubs help create stronger and more adaptable supply chains. They achieve this by offering multimodal transport options like rail and trucking, which ensure goods can move more smoothly and with fewer disruptions - critical in fast-paced trade environments.

These hubs also boost efficiency and reduce costs by strategically positioning goods closer to consumer markets. This approach cuts transportation expenses, eases the strain on seaports, and speeds up delivery times. Beyond operational advantages, inland hubs play a key role in supporting the growth and scalability of supply chains, helping drive economic progress and expand logistics networks across the region. For emerging markets, these hubs are a game-changer, enabling them to handle increasing trade demands while maintaining supply chain reliability.

What steps can businesses in the UAE take to reduce the impact of disruptions along the Red Sea trade routes?

Businesses in the UAE can lessen the effects of disruptions in the Red Sea trade route by turning to inland supply chain hubs. Facilities like bonded inland container depots offer a more flexible approach, reducing dependence on busy maritime routes.

Investing in inland logistics infrastructure, such as rail networks and inland ports, creates alternative transportation solutions. This ensures operations run more smoothly, even when external challenges arise. These steps not only strengthen supply chain reliability but also cut transit times and logistical risks, paving the way for more efficient and scalable business growth in the region.

What challenges might businesses encounter when shifting from Red Sea trade routes to inland supply chain hubs?

Transitioning from depending on Red Sea trade routes to developing inland supply chain hubs comes with its own set of hurdles. Among the biggest challenges are managing more complex logistics, making significant initial investments in infrastructure, and ensuring strong risk management systems to tackle regional concerns like geopolitical tensions and piracy.

On top of that, businesses might encounter short-term disruptions and higher costs as they work to build new transportation networks and align them with their current systems. To navigate these challenges effectively, careful planning and a well-thought-out strategy are crucial to minimise delays and ensure the shift happens as smoothly as possible.